Chase Sapphire Preferred: The Ultimate Travel Card

Looking for a card with top travel rewards, flexible redemption, and great perks? Choose Chase Sapphire Preferred.

Anúncios

Designed for travelers and food enthusiasts, this card provides an excellent balance of benefits and affordability.

With generous point-earning opportunities and valuable travel protections, Chase Sapphire Preferred is a must-have for those who want to maximize their spending.

Whether you’re dining out, booking flights, or staying in luxury hotels, this card ensures you get the most out of every dollar spent.

Plus, it comes with an attractive sign-up bonus, making it even more appealing to those looking for a high-value rewards card.

Anúncios

The ability to transfer points to leading travel partners further enhances its reputation as a top-tier travel credit card.

If you want a card that rewards your everyday purchases while also offering premium travel perks, look no further.

Why Choose the Chase Sapphire Preferred?

There are plenty of credit cards on the market, but the Chase Sapphire Preferred stands out for several reasons.

First, its rewards structure is one of the most competitive in the industry.

You’ll earn bonus points on travel and dining, making it a fantastic option for those who spend frequently in these categories.

Second, its points are incredibly flexible.

Chase Ultimate Rewards points can be redeemed for cash back, travel, gift cards, or even transferred to airline and hotel loyalty programs for potentially higher value.

This flexibility ensures you get the most out of your rewards, no matter how you prefer to use them.

Finally, the Chase Sapphire Preferred offers superior travel protections, including trip cancellation insurance, primary rental car coverage, and baggage delay reimbursement.

These benefits provide peace of mind and add immense value to the card.

Benefits of the Chase Sapphire Preferred

It’s packed with benefits that make it the best choice for frequent travelers and everyday spenders:

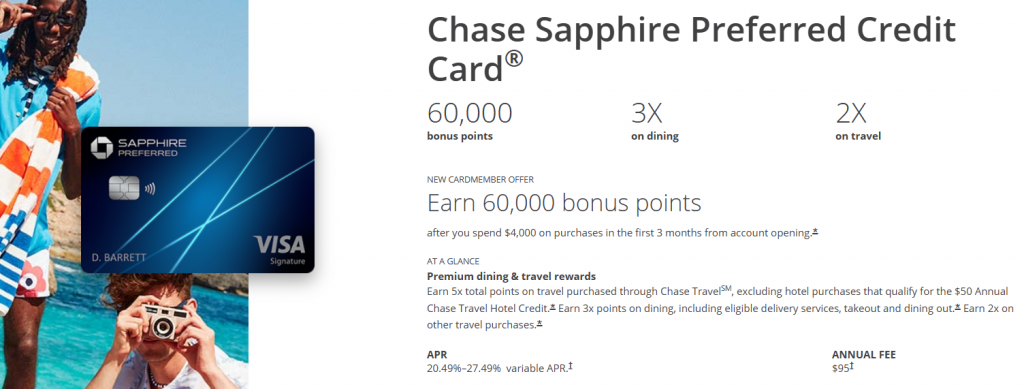

- Generous Sign-Up Bonus – New cardholders can earn a substantial bonus after meeting the minimum spending requirement.

- High Earning Potential – Earn extra points on travel and dining purchases, plus one point per dollar on all other purchases.

- Point Transfer to Travel Partners – Transfer your points at a 1:1 ratio to top airline and hotel loyalty programs.

- Enhanced Redemption Value – When you redeem points for travel through Chase Ultimate Rewards, they are worth 25% more.

- Comprehensive Travel Protections – Enjoy trip delay reimbursement, lost luggage insurance, and more.

- No Foreign Transaction Fees – Use your card internationally without worrying about extra charges.

- Exclusive Travel and Dining Perks – Access unique experiences, priority reservations, and special discounts.

Fees Associated with the Chase Sapphire Preferred

While the Chase Sapphire Preferred offers outstanding value, it’s essential to consider its costs:

- Annual Fee – The card has a reasonable annual fee, especially considering its generous rewards and benefits.

- APR – Interest rates vary based on creditworthiness, so paying your balance in full each month is recommended.

- Balance Transfer & Cash Advance Fees – Like most credit cards, balance transfers and cash advances come with associated fees.

- Late Payment & Penalty Fees – Avoid these by making timely payments to maintain a strong credit profile.

Overview

The Chase Sapphire Preferred is the perfect travel credit card for individuals who want a mix of affordability, rewards, and premium benefits.

With its excellent earning potential, valuable redemption options, and strong travel protections, it’s easy to see why this card remains a favorite among travelers and food lovers.

If you’re searching for a well-rounded credit card that offers exceptional rewards and perks, the Chase Sapphire Preferred is a solid choice.