The Credit Card That Maximizes Your Cashback

For those seeking real benefits and great returns, the Amex Blue Cash Preferred is an excellent option.

Anúncios

With a proposal for those seeking substantial cashback in key categories, this American Express card offers great rewards.

It provides exclusive benefits, especially for those who shop at supermarkets, use streaming services, or fuel their cars.

The Amex Blue Cash Preferred is ideal for maximizing rewards in these areas. Let’s dive into its features and benefits.

In this article, we’ll explore its perks, fees, and unique advantages. Keep reading to see if it’s the right choice!

Anúncios

About the Card

The Amex Blue Cash Preferred is an ideal credit card for those looking to earn substantial cashback on everyday purchases.

This card stands out by offering excellent returns in essential spending categories, helping users maximize their rewards while managing their daily expenses.

One of its most attractive features is its high cashback rate on supermarket purchases.

This makes it an excellent choice for families or anyone who spends a significant amount on groceries.

In addition, the card offers generous rewards for streaming services, such as Netflix, Hulu, and Spotify, making it a great option for entertainment lovers.

Another key benefit is its cashback on transportation expenses, including gas stations and public transit.

This ensures that your daily commute or road trips can also contribute to your cashback earnings.

Beyond the cashback benefits, the Amex Blue Cash Preferred offers additional perks like purchase protection, exclusive event access, and premium customer service.

These added features make it a reliable and rewarding choice for many consumers.

Main Benefits

High Cashback

The Amex Blue Cash Preferred stands out for its generous cashback program.

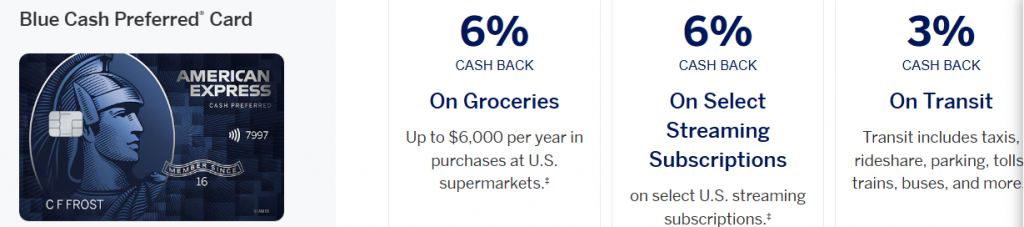

Users can earn up to 6% cashback at U.S. supermarkets (up to an annual limit) and 6% on select streaming services.

Additionally, there is 3% cashback on gas stations and transit and 1% on all other purchases.

Exclusive Benefits

Beyond impressive cashback, the card includes benefits such as purchase protection and an extended warranty on acquired products.

It also offers access to special offers at cultural and sports events.

Flexible Redemption

The accumulated cashback can be used to reduce your statement balance, making it a true financial ally.

Fees

The Amex Blue Cash Preferred has an annual fee, which can be easily offset by the high cashback returns.

Additionally, the card has a variable interest rate, depending on the customer’s profile and credit usage.

It’s essential to analyze whether your spending volume in high cashback categories justifies this annual fee.

For frequent users of these benefits, the savings generated can easily outweigh the cost.

Card Differentials

Competitive Cashback Program

Few cards offer 6% cashback on supermarkets and streaming, making the Amex Blue Cash Preferred one of the best options for maximizing rewards.

American Express Security and Support

The card features advanced security technology, fraud monitoring, and highly recognized customer service for efficiency.

Additional Benefits

Beyond cashback, the card also includes perks such as car rental insurance, access to pre-sales for exclusive events, and an extended warranty for purchases.

Overview

The Amex Blue Cash Preferred is designed for those who want to optimize daily expenses and get an excellent return through cashback.

With top rewards and exclusive perks, it’s a top choice for saving while using your credit card.

If you’re looking for a card that offers high cashback and exclusive advantages, the Amex Blue Cash Preferred could be the right choice for you.

Amex Blue Cash Preferred: High Cashback for Everyday Spending

For those seeking real benefits and strong returns, the Amex Blue Cash Preferred® Card stands out as one of the best cashback credit cards available today.

Designed for consumers who spend heavily on groceries, streaming services, and transportation, this card delivers exceptional rewards in everyday categories where expenses naturally add up. If your goal is to turn routine spending into meaningful cashback, this card deserves serious consideration.

In this guide, we’ll explore the card’s main features, benefits, fees, and what truly makes it unique—so you can decide if it’s the right fit for your financial lifestyle.

About the Amex Blue Cash Preferred

The Amex Blue Cash Preferred is built for practical, everyday use. Unlike many rewards cards that focus on travel or rotating categories, this card consistently rewards essential spending.

Its standout feature is the high cashback rate at U.S. supermarkets, making it especially appealing to families and individuals with significant grocery expenses. On top of that, the card rewards popular streaming services and transportation costs, turning entertainment and commuting into additional savings.

Beyond cashback, American Express enhances the experience with premium customer service, purchase protections, and exclusive access to events and offers—adding value well beyond simple rewards.

Main Benefits

High Cashback Rates

The Amex Blue Cash Preferred offers one of the most generous cashback structures in its category:

- 6% cashback at U.S. supermarkets (up to an annual spending cap)

- 6% cashback on select U.S. streaming services, including Netflix, Hulu, Disney+, and Spotify

- 3% cashback on U.S. gas stations and transit, including rideshares and public transportation

- 1% cashback on all other eligible purchases

Source: American Express

This rewards structure makes the card ideal for maximizing returns on essential monthly expenses.

Exclusive Cardholder Benefits

In addition to cashback, cardholders enjoy:

- Purchase Protection against theft or damage

- Extended Warranty, adding extra coverage to eligible purchases

- Car rental loss and damage insurance

- Access to Amex Offers, providing targeted discounts and statement credits

- Presale access and special invitations to select entertainment and cultural events

These benefits enhance both everyday purchases and larger investments.

Simple and Flexible Redemption

Cashback earned with the Amex Blue Cash Preferred is easy to use. Rewards can be redeemed as statement credits, directly reducing your balance and helping you save real money without complicated redemption systems.

Fees and Costs

The card does come with an annual fee, which is something to consider carefully. However, for users who regularly spend in the high-reward categories—especially groceries and streaming—the cashback earned often more than offsets the annual cost.

The card also carries a variable APR, based on credit profile and market conditions. As with any rewards card, paying the full balance each month helps avoid interest charges and maximizes the card’s value.

What Makes This Card Different

Market-Leading Cashback Categories

Very few cards offer 6% cashback on both supermarkets and streaming services, positioning the Amex Blue Cash Preferred among the strongest cashback options available.

Trusted American Express Security

Advanced fraud detection, instant alerts, and Amex’s highly rated customer support provide peace of mind for everyday and online purchases.

More Than Just Cashback

With protections, insurance benefits, and exclusive access, the card delivers value beyond rewards alone.

Overall Verdict

The Amex Blue Cash Preferred® Card is an excellent choice for consumers who want to maximize cashback on everyday expenses while enjoying premium benefits.

If you spend regularly on groceries, streaming subscriptions, gas, or transit, this card can generate substantial savings throughout the year. When used strategically, the rewards can easily outweigh the annual fee, making it a powerful financial tool for daily life.

For anyone looking to optimize household spending and earn meaningful cashback without complex rules, the Amex Blue Cash Preferred is a top-tier option worth considering.